Table of Contents

- What is Underwriting Workbench?

- How AI is Transforming Traditional Risk Assessment in Underwriting?

- Benefits of AI-Powered Underwriting Workbench

- How Does Tx Enable Intelligent Underwriting Transformation?

- Summary

Underwriters today are dealing with an array of challenges that are affecting their expertise and efficiency. New Tech trends, climate crises, and global instability have given rise to complexities demanding agility in risk assessment and analysis. According to a report, 41% of underwriters’ efforts are currently drained by administrative and operational tasks. This binds their capabilities and triggers value chain challenges in customer experience and pricing.

To address these challenges, an underwriting workbench can serve as a unified station where data, tools, and underwriting processes can sync. When integrated with AI-powered risk analysis, Workbench can help automate tasks, offer quality data, and facilitate collaboration in a single place.

What is Underwriting Workbench?

An Intelligent Underwriting Workbench is an AI-enabled, centralized digital platform that supports underwriters in making data-driven and more accurate risk decisions. It integrates tools, workflows, analytics, and data sources into a single and unified interface. Insurers leverage AI and automation with their Workbench to simplify and streamline the underwriting process. Its key characteristics include:

• A unified interface combines risk data, rule engines, documentation, and pricing tools in one view.

• AI-powered risk analysis using ML to predict risk levels, suggest pricing, and flag anomalies.

• Automated data ingestion enables the extraction and interpretation of unstructured data using NLP and OCR.

• Workflow orchestration guides underwriters through tasks, approvals, and reviews seamlessly.

• Capture decisions and risk logic for transparency and regulatory reporting for auditability and compliance.

How AI is Transforming Traditional Risk Assessment in Underwriting?

Underwriting is an important insurance task that involves evaluating risk factors before issuing policies. In the past, underwriters had to depend on historical data, valuation reports, and manual risk assessments. These methods were limited in their ability to analyze large data volumes accurately and quickly. AI-powered underwriting workbenches enable real-time risk assessment using ML, NLP, and automation. According to a report, AI-enabled underwriting reduces risk assessment time by 50%, uplifting efficiency and improving customer satisfaction. Here’s the breakdown of how AI is restructuring underwriting risk assessment:

| Traditional Risk Assessment | AI-Powered Risk Assessment via Intelligent Workbench |

|---|---|

| Underwriters manually collect and review data from multiple sources, causing delays, inconsistencies, and a fragmented view of risk. | The intelligent underwriting workbench automatically pulls data from internal systems, external APIs, and third-party sources in real time. Data is centralized and unified, instantly providing underwriters with a 360° risk view. |

| Document review is a manual and time-consuming process. Underwriters read through lengthy files like financial statements or medical reports. | Integrated NLP and OCR tools within the workbench instantly extract, classify, and summarize key information from unstructured documents, saving time and reducing human error. |

| Risk scoring relies on static, rules-based logic, and fixed underwriting guidelines. Updates are infrequent and reactive. | Embedded machine learning models generate dynamic, data-driven risk scores as they continuously learn from past outcomes and market data. |

| Fraud detection is reactive, based on basic rules and red-flag alerts reviewed manually. | AI within the workbench proactively identifies anomalies or inconsistencies in applications, documents, and risk profiles to flag fraud earlier and with more precision. |

| Audit trails and compliance documentation are often manually generated and prone to gaps. | Every decision, data point, and AI recommendation is logged automatically within the workbench, ensuring complete auditability and regulatory transparency. |

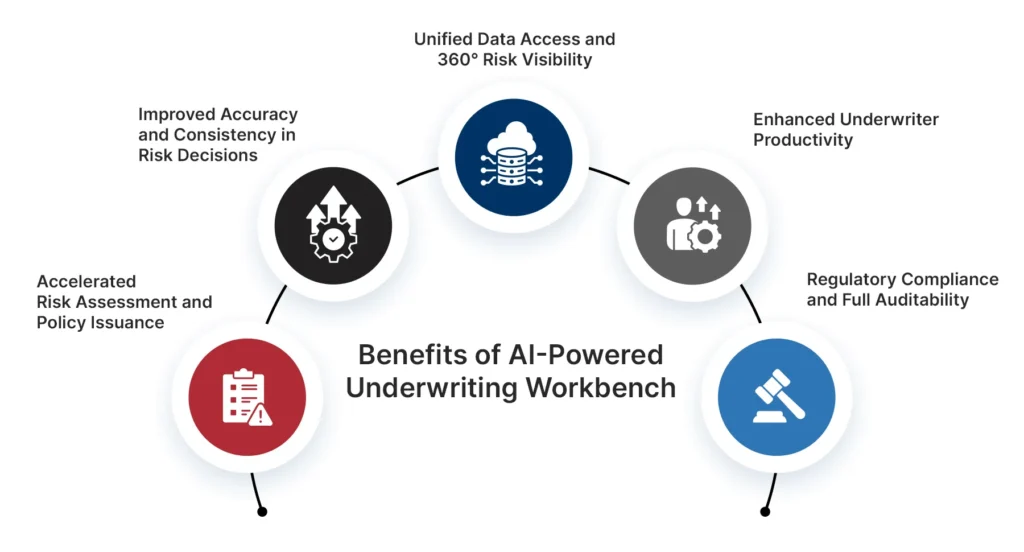

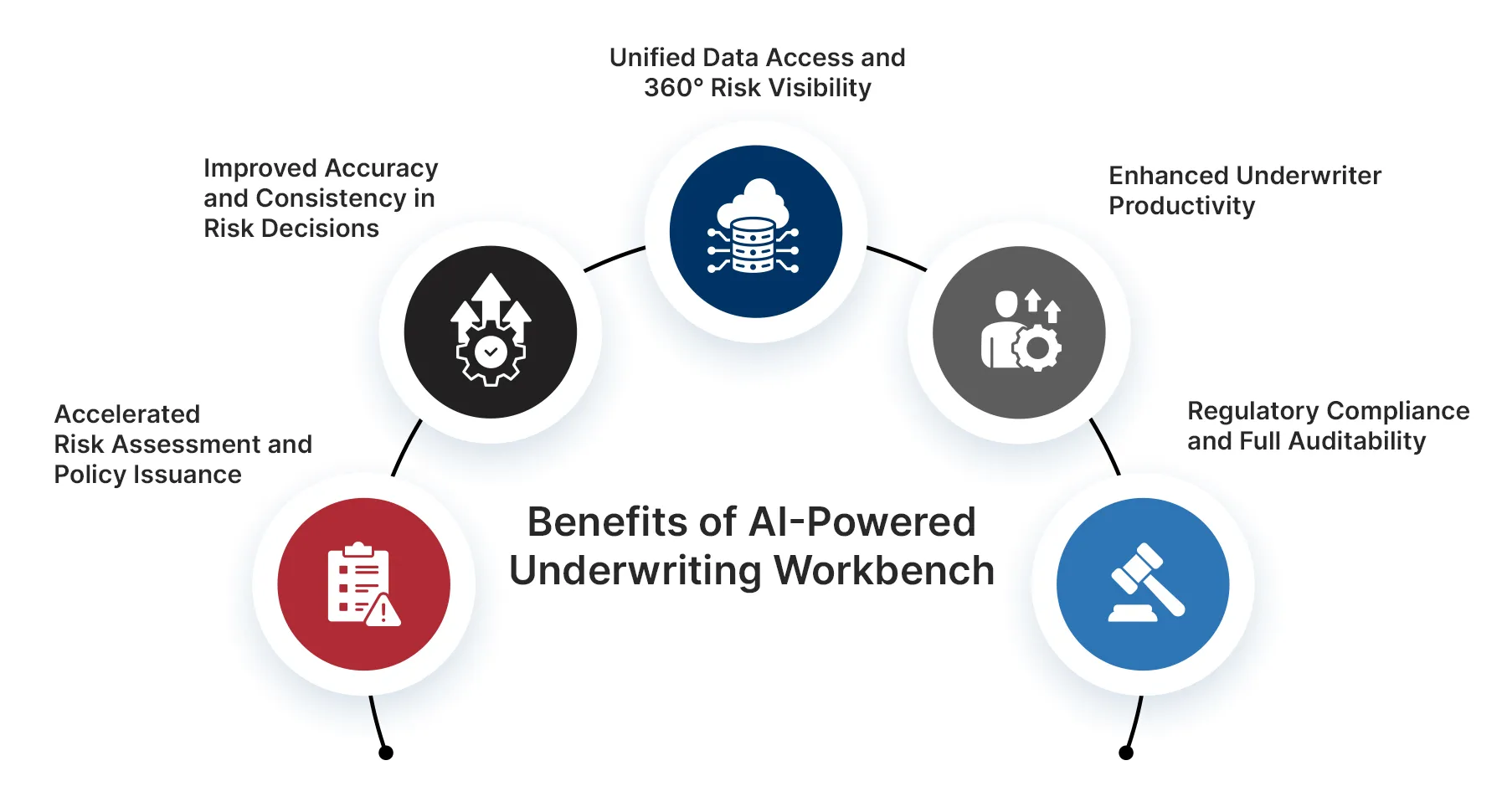

Benefits of AI-Powered Underwriting Workbench

AI-powered underwriting workbenches combine automation, real-time data, and advanced analytics to help insurers underwrite smarter, faster, and more accurately. Below are the top benefits insurers can gain by implementing an AI-powered underwriting workbench:

Accelerated Risk Assessment and Policy Issuance:

AI-powered underwriting workbenches reduce turnaround times by automating data intake, document processing, and risk scoring. Insurers can move from days to real-time or same-day decisions, enabling faster quote-to-bind cycles and improved customer experience.

Improved Accuracy and Consistency in Risk Decisions:

ML models use historical data, behavioral patterns, and third-party insights to assess risk more precisely. This results in more consistent and objective underwriting decisions, reducing manual bias, and underwriting leakage.

Unified Data Access and 360° Risk Visibility:

The workbench consolidates data from core policy systems, external databases, IoT devices, and underwriting rules engines. This gives underwriters a single, real-time view of the applicant, reducing the need to switch between systems or find missing information.

Enhanced Underwriter Productivity:

AI handles repetitive, low-value tasks like form validation and document sorting. It helps underwriters to focus on complex cases and high-value judgment, increasing throughput and reducing decision fatigue.

Regulatory Compliance and Full Auditability:

Every action, data point, and AI recommendation is automatically recorded. This helps insurers fully comply with internal guidelines and regulatory requirements and enables model explainability and audit traceability.

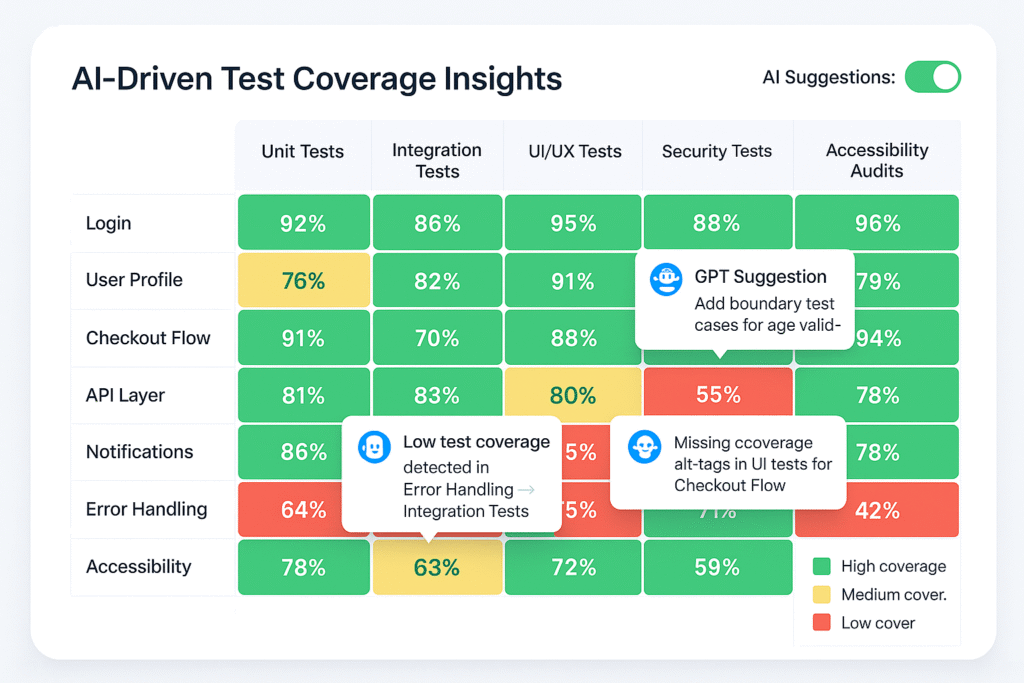

How Does Tx Enable Intelligent Underwriting Transformation?

As you work towards modernizing your underwriting processes with AI and digital platforms, you will require robust QA, data integrity, and scalable automation processes. Tx can help you deliver trustworthy and high-performing underwriting workbenches by offering the following solutions:

AI Model Validation & Testing:

We rigorously validate data inputs, model logic, and results to ensure your AI models produce accurate, explainable, and unbiased outcomes. This helps you comply with insurance regulatory frameworks and gain trust in AI-driven decisions.

End-to-End Underwriting Workbench Testing:

We conduct comprehensive functional, integration, and user acceptance testing (UAT) across your underwriting platform. This ensures the workbench operates seamlessly across systems, channels, and user roles, reducing downtime and underwriting errors.

Test Automation:

We build and maintain automated test frameworks that support Agile and DevOps workflows, enabling faster and safer releases of underwriting features. Our in-house accelerators (Tx-Automate, Tx-Insights) allow you to scale models, workflows, and interface updates without compromising quality or speed.

Data Integrity & Migration Assurance:

Our teams validate the accuracy and consistency of structured and unstructured data flowing into AI systems and underwriting engines. We ensure that data migrations from legacy systems are error-free, policy-compliant, and aligned with business rules.

Summary

An AI-powered underwriting workbench improves the insurance underwriting process by unifying data, tools, and workflows into a centralized platform. It enables real-time, data-driven risk assessment through automation and intelligent analytics, enhancing decision accuracy and operational efficiency. Underwriters benefit from seamless access to relevant data, streamlined processes, and improved productivity.

Tx supports this transformation by offering AI model validation, end-to-end testing, automation frameworks, and data integrity services tailored for insurance workflows. With IP-led accelerators and deep expertise, we provide reliable, scalable, and compliant underwriting platforms that align with your digital insurance initiatives. Contact our insurance industry experts now to learn how Tx can assist you.

The post AI Workbenches Powering the Next Era of Underwriting | Don’t Catch Up. Leap Ahead first appeared on TestingXperts.

Source: Read More